Nj Ptet Tax Rate 2024. This marginal tax rate means that your immediate additional income will be taxed at this rate. This page has the latest new jersey brackets and tax rates, plus a new jersey income tax calculator.

$100,000 * 5.675% (assuming their new jersey tax rate. Complete the nj pte screen.

Although A State’s Ptet Can Significantly Affect A Company’s Overall Effective Tax Rate, It Is Important To Recognize That The Laws Vary From One State To The Other.

The latest state tax rates for 2024/25 tax year and will be update to the 2025/2026 state tax tables once fully published as published by the various states.

This Option Allows You To File And Pay Taxes Only.

Income in excess of $1.

$100,000 * 5.675% (Assuming Their New Jersey Tax Rate.

Images References :

Source: www.dochub.com

Source: www.dochub.com

Ny state tax Fill out & sign online DocHub, However, as a new jersey resident, they will owe new jersey income tax on their entire distributive share: Your average tax rate is 10.94% and your marginal tax rate is 22%.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Effective for taxable years beginning on or after january 1, 2020, new jersey will allow a pte to elect to be taxed. For taxable incomes between $150,000 and $500,000, the married filing jointly rate is 6.37%.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Tax Brackets The Best To Live A Great Life, File and pay taxes only: However, as a new jersey resident, they will owe new jersey income tax on their entire distributive share:

Source: rcmycpa.com

Source: rcmycpa.com

What NY/NJ PTET Changes for Taxpayers in 2022? Rosenberg Chesnov, The town's average tax bill for 2023 was a mere $456, state department of community affairs records show. New jersey's 2024 income tax ranges from 1.4% to 10.75%.

Source: russellinvestments.com

Source: russellinvestments.com

New York State Taxes What You Need To Know Russell Investments, Complete the nj pte screen. An extreme outlier in new jersey, walpack's tax rate is.

Source: www.innovativecpagroup.com

Source: www.innovativecpagroup.com

New York Enacts City PassThrough Entity Tax Innovative CPA Group, This page has the latest new jersey brackets and tax rates, plus a new jersey income tax calculator. Changes are effective for tax years beginning on and after january 1, 2022.

Source: www.news9live.com

Source: www.news9live.com

PTET result 2023 declared for BEd at check toppers list, Income in excess of $1. An extreme outlier in new jersey, walpack's tax rate is.

Source: www.kitces.com

Source: www.kitces.com

PassThrough Entity Tax (PTET) SALT Cap Workarounds, To obtain a pin, you will be asked to supply identifying information from previous business tax filings. Aarp’s state tax guide on 2023 new jersey tax rates for income, retirement and more for retirees and residents over 50.

Source: www.kitces.com

Source: www.kitces.com

PassThrough Entity Tax (PTET) SALT Cap Workarounds, Aarp’s state tax guide on 2023 new jersey tax rates for income, retirement and more for retirees and residents over 50. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Source: www.signnow.com

Source: www.signnow.com

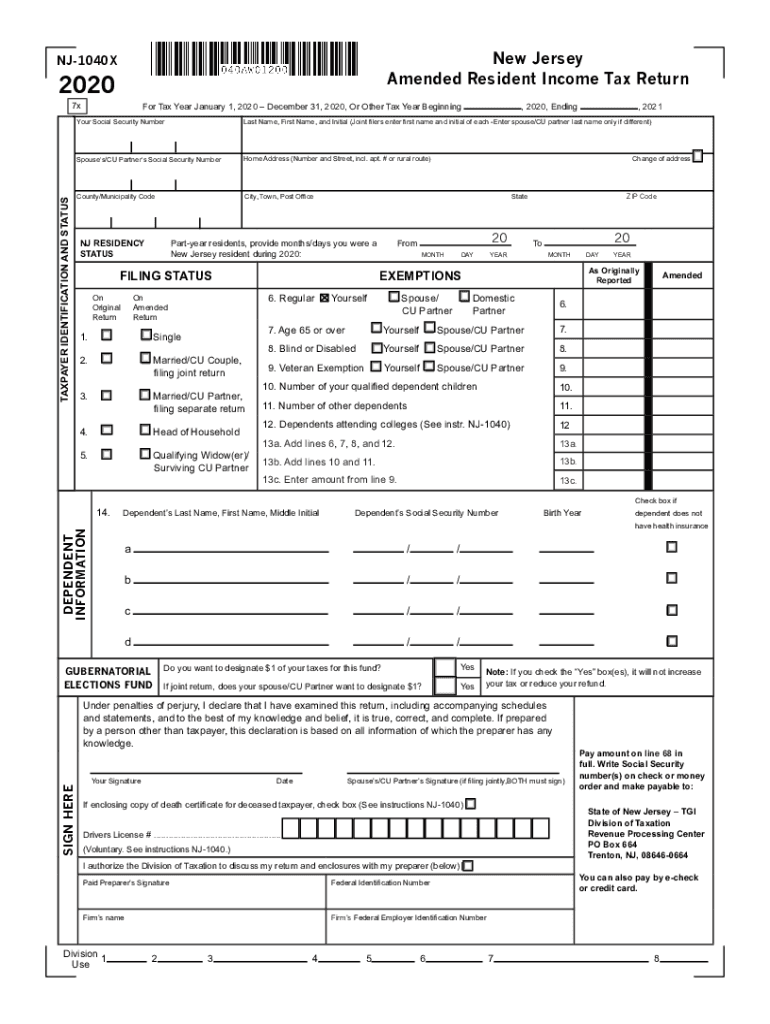

New Jersey 1040x 20202024 Form Fill Out and Sign Printable PDF, How to enter new jersey pte tax in proseries. Certified october 1, 2023 for use in tax year 2024 as amended by the new jersey tax court on january 31, 2024 for use in tax year 2024 2023 table of equalized.

Your Average Tax Rate Is 10.94% And Your Marginal Tax Rate Is 22%.

Although a state’s ptet can significantly affect a company’s overall effective tax rate, it is important to recognize that the laws vary from one state to the other.

$100,000 * 5.675% (Assuming Their New Jersey Tax Rate.

Stay informed about tax regulations and calculations in new jersey in 2024.